CNBC’s Jim Cramer said on Friday that this week was the latest example of the market gone crazy after a Federal Reserve meeting.

But based on past market reactions to the central bank’s previous rate hikes, this week’s activity may prove not to be that meaningful in the long run, he said.

The initial reaction to the Fed’s moves is “almost always a head fake,” Cramer said.

The market had a big reaction this week following the Fed’s latest move, Cramer noted — with a hard sell-off on Wednesday, followed by a small comeback on Thursday and a chaotic session Friday. While newfound turmoil in the European financial sector dragged down stocks early Friday, they recovered after those markets closed.

Following the central bank’s quarter point rate hike on Wednesday, there have been nine increases in just over a year.

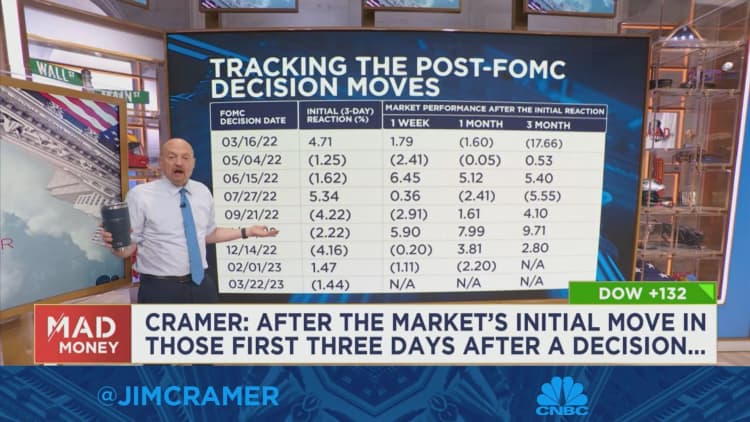

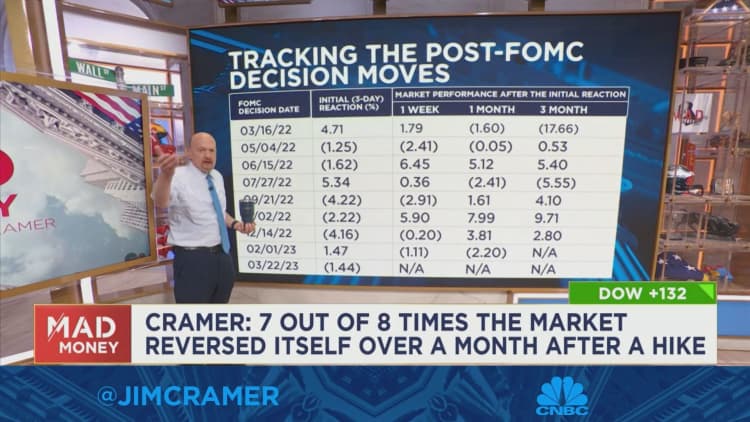

The market has tracked a pattern in which — after the first three days following a Fed decision — it will usually go in the opposite direction the next month, Cramer said.

When looking at the previous eight rate hikes this cycle, the market reversed direction over the following month seven out of eight times. (There is not enough data to run an analysis on the February rate hike.)

The only exception was the second one that occurred in early May. That prompted a hard sell-off that lasted several days, and markets were basically flat in the month that followed.

Generally, when you zoom out three months, the initial market moves — whether they are positive or negative — tend to reverse themselves every time, Cramer said.

The pattern is too overwhelming to ignore, Cramer said.

To be sure, it remains to be seen whether that same pattern will hold this time, or whether the negative initial reaction to the Fed’s move this week will reverse itself.

This time, with new emergencies cropping up practically every day, especially in the banking sector, it “feels dangerous” to predict a rally over the next three months, Cramer said.

But the bottom line is, we’ve been here before, he stressed.

“So, take a deep breath, drink some tea and remember that the initial reaction to the Fed’s rate hikes has been wrong every time over the past year,” Cramer said.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)