Hancom is a name ubiquitous to Koreans as Samsung and LG.

As one of South Korea’s oldest software companies, it is known for its Hangul word processing application, the country’s answer to Microsoft Word. Hangul launched in 1989 and is till today the second most used word processing application behind the US company. Hancom literally stands for “Korean and Computer.” As of 2021, Hancom was worth around $350 million on the Korean stock market.

Today, Hancom CEO Kim Yeonsu, has an ambitious goal: to make the Hancom name ubiquitous outside of South Korea as well.

“My desire is for every respectable software developer in the world to know Hancom, even before I meet them face-to-face when I go abroad,” she said, who became CEO of Hancom in August 2021 and is heiress-apparent to the business group. She joined Hancom Group in 2012 and rose through the ranks to take up key executive positions, mostly responsible for mergers and acquisitions, as well as management of subsidiaries, before taking the top job of the group’s flagship.

According to Yeonsu, Hancom has started a shift from its previous installation-based software business model to a cloud-based, subscription service business model. The company is offering its Hancom Office in software-as-a-service (SaaS) format, which is being used more and more by global audiences on a daily basis, the CEO said.

The South Korean software company has also been aggressive in acquisitions to expand globally. Its Singapore-based subsidiary Hancom Alliance will complete the acquisition of Taiwanese SaaS firm KDAN Mobile to expand in North America, Europe and Asia. Hancom is also considering making a strategic investment in Southeast Asian HR SaaS company Swingvy. “We plan to quickly expand in the global cloud market through acquisitions of promising SaaS companies like KDAN.”

“Hancom is currently valued at around 400 billion won; my goal is to increase this to 4 trillion won. I am confident that this can be achieved.” In her first-ever interview, exclusively with ZDNet, Yeonsu, soft-spoken yet firm, was honest about Hancom’s challenges ahead, but also bullish when it came to the future of the company.

A TABLE SET FOR DEVELOPERS

The CEO and her top executives are planning to take part in Mobile World Congress 2023 kicking off later this month. Yeonsu says she will be looking for new business opportunities and partnerships with developers.

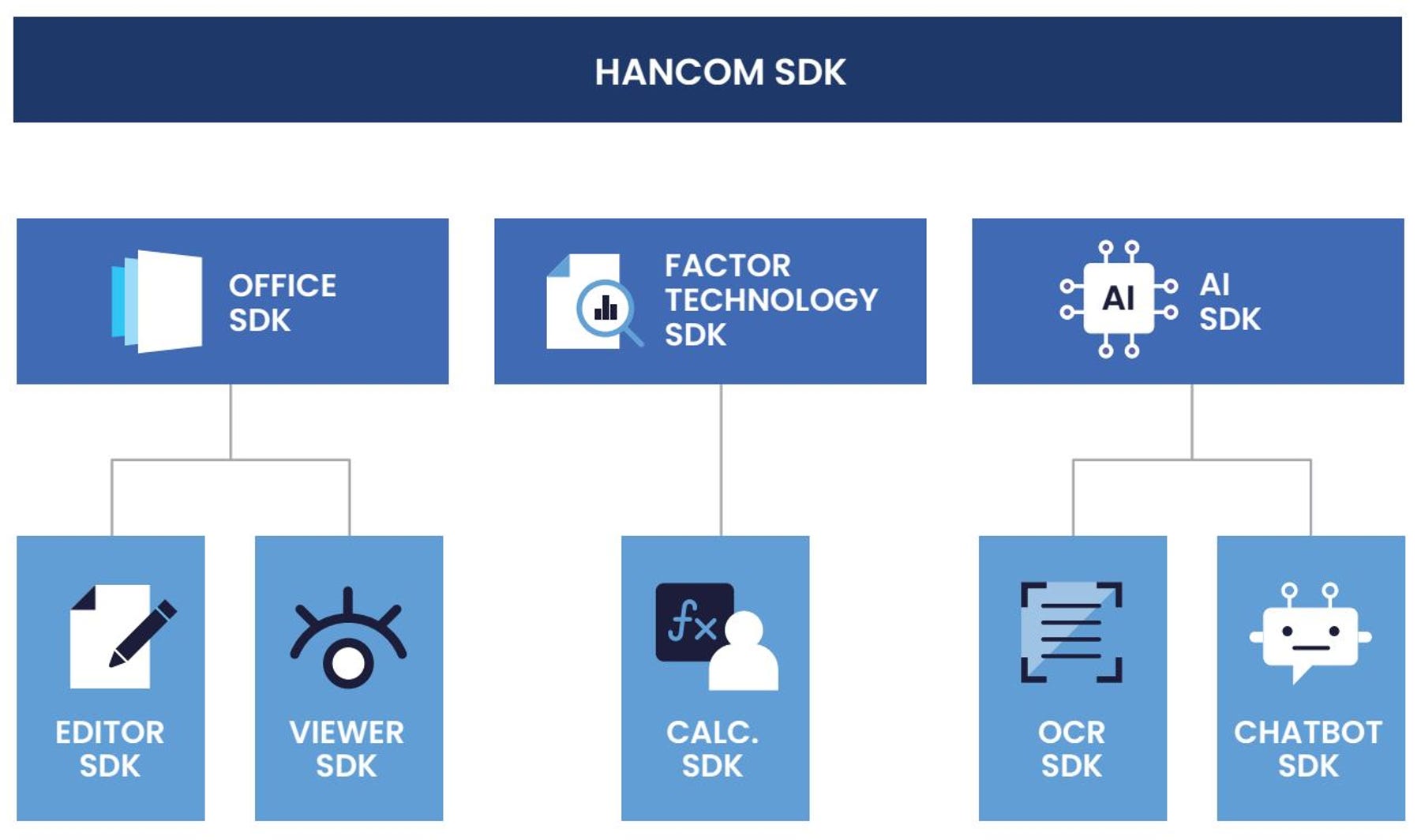

And the main offering will be Hancom’s SDK, or software development kit, for all the technologies and software on Hancom Office, the company’s own version of office suite that includes Hangul word processor, spreadsheet, presentation, and PDF editor.

“Our strategy since last year can be summed up in one word, growth,” the CEO said, “and collaboration with global developers is essential to that.” To use an analogy, Yeonsu said Hancom will be setting a table full of various foods for developers in North America and Europe to choose each according to their tastes.

“To go global, we realized that we can’t provide software packed with various functions that customers may or may not want. So we are splitting what we have into pieces of technologies so that the customers have the freedom to choose.”

Last year, Hancom became a shareholder of Taiwanese software company KDAN, which offers solutions for mobile PDF, e-signature, and animation. The Taiwanese firm also has its own AI document management service that competes with Adobe Creative Cloud. “We have strength as an editor, but the different formats we are editing, from word to PDF, present different scenarios. Our expertise in the PDF format was relatively weaker. KDAN had that expertise in PDF.”

Approximately 80% of KDAN’s revenue and customers are from North America and Europe, Yeonsu said, providing Hancom with an entry point for those markets as part of its global expansion plan. KDAN, founded in 2009, also has recorded over 100 million downloads for its app in Taiwan and is a well-established brand there, she added, allowing Hancom to expand there as well.

Hancom’s global expansion will focus on North America and Europe as markets there generally have high spending in software, the CEO said. On the other hand, conventionally, Asian markets require a lot of customization from the software provider to fit the local market, Yeonsu said, which requires a relatively large local team for system integration. “So we want to provide the technologies we have first, then find out what our customers’ needs are. That way, we can select the technologies that are suitable for further development which we can feel confident about.”

This blueprint for global expansion largely stems from Yeonsu’s experience from Hancom’s acquisition of Belgium-based PDF solution firm iText in 2015 and later selling the company in 2018 to private equity Crescendo Equity Partners. After the sale, Yeonsu continued to manage iText as CEO and chair of the board for three years.

“During my tenure at iText, we tried to find a role in the Asian market as well. What we learned was that we couldn’t just sell the services of iText to these markets but needed to offer consulting services as well. So this experience shaped how I think a Korean software company should approach expanding globally. ‘We have these various technologies; this is our licensing policy,’ and help customers find what they need.”

Besides expanding abroad, in terms of the South Korean market, Yeonsu said that the company was looking for new business opportunities by utilizing the accumulated data from providing the Korean language word processor application Hangul for 32 years. “For us this accumulated document, or data, is an asset. We are thinking of various scenarios, such as a comparison of how the Korean language was used in an older document to a more recent one. We also want to improve the Hangul format itself.”

This utilization of data, which AI can assist in, is very much an ongoing homework for the CEO.”We provide an editor: a tool to document information in various formats, from word to PDF. Now more than ever, we are looking at our editor as a container of information.

“So one of the things we think about is how to extract what information and how to apply it so that we can solve customers’ problems. AI is one of the tools we use for this, but AI or not, we think more in terms of what value the application of a specific technology can provide for the customers.” Yeonsu stressed that forming SDK collaboration with developers will also give Hancom access to more data.

CULTURE SHIFT

Yeonsu’s experience abroad and managing foreign companies has also shaped her management style. She sums up her own style as pragmatic and to the point. Her executives that I talked to described her as an entrepreneur who stresses the importance of overcoming challenges, freedom, quick decision-making, and personal responsibility. Communication seems to be one of Yeonsu’s top agendas: soon after she was nominated as CEO, in November 2021 Hancom sent its first shareholder letter.

Most Korean companies still are very hierarchical. Most employees call each other by their last names combined with their positions, which are usually given based on seniority and age. The Korean language also has honorifics, where someone talking to another that is older or of higher status uses special nouns and verb endings.

Hancom under Yeonsu has done away with much of this and employees call each other by their full names without their positions. Yeonsu herself is called Yeonsu by her subordinates. Employees use honorifics between each other regardless of position, which is considered more polite than not using any honorifics. This sets an atmosphere of respect for individuals but with boundaries.

“My experiences in North America and Europe have changed how I approach convincing and becoming friendly with people,” the CEO said. “This is also the same for my employees. When I negotiate with them, when I convince employees to work with me, it is really about finding common ground.”

Instead of a top-down structure, Yeonsu strongly prefers forming a consensus. “I think how much consensus a goal has within the company correlates to how successfully the goal was achieved.”

Traditional Korean companies, similar to their counterparts in Japan and China, have also in the past demanded employees to put the good of the company before themselves, but this work culture has shifted tremendously around the past five years by the global debate over work as well as the pandemic, and Hancom has also been impacted by these societal trends.

“Since I started my career in Korean companies, I’ve also had the mentally of ‘everything for the job’ and expected the same from colleagues in the past. I no longer approach management this way.”

“Even before I became the CEO, there was a rift between the older generation and the younger generation, culturally speaking, and there were efforts to bridge this gap by the company even before I took the helm. So I would say the Hancom culture today was formed partly from my direction and the natural evolution of perception about work in South Korea.”

But Yeonsu also stresses the importance of personal responsibility that each employee must have, if they want the so-called work and life balance. “The company’s role is to set a clear standard of manner to the employee and between employees. Also, a company must give clear roles and responsibilities to the individual. But after that, it is up to the individual.”

“We have to think about the end goal. The end goal of setting a work culture is to communicate and work better together.”

Starting this year, Hancom is also planning to implement a new process where the company and employees on a mutually accepted goal that will be evaluated at year’s end. This process was tested in small units last year but will now be implemented in Hancom headquarters in South Korea.

When it comes to culture and HR, however, the CEO said this also needs to be based on where a certain operation is based. For example, Taiwan will have its own HR; South Korea its own as well; there will also need to be a Global HR, Yeonsu said.

Another change the CEO made was what Hancom’s own developers focus on and how they approach work. “In the past, our own developers mostly focused on technologies related to Hangul. But to coincide with our expansion, I have given them more freedom to choose and develop the technologies they want that ultimately fit our end goal of providing value to customers. Failure is OK, as long as there is something we can learn from it.”

“We have software developers with decades of experience. We have legacy assets as a software service provider that operated for decades. I would say we are yet to fully utilize these to their full potential and we are always thinking of ways to do so.”

Hancom CEO Kim Yeonsu Image: Hancom

FOR THE ALLIANCE: MORE ACQUISITIONS

Yeonsu said that Hancom is preparing for more acquisitions of companies that fit into the company’s overall strategy. “You have to look at what you have as a company before you think about acquisitions. What we are good at and where that can take us.”

The CEO also shared her thoughts on how she chooses candidates: “Most important is the people. Who I work with. I also avoid companies that are looking for a public sale.

“When it comes to acquisitions in the past, most of it came organically by our executives working well with their executives.”

Yeonsu said after an acquisition, she gives clearly defined roles between Hancom and the newly acquired company. “Sometimes Hancom will be able to acquire a new arena from the acquired company. Sometimes Hancom will work with the acquired company to secure new arenas.”

“For example, KDAN will be using our Office SDK to launch a KDAN Office in Taiwan. We wrapped our office engine and gave it to KDAN, which added UI and UX that fit better with the local market.

Hancom set up a subsidiary called Hancom Alliance in Singapore last year in September, a company that will be looking for strategic investments and partnerships with companies like KDAN.

The Hancom Alliance brand will be subservient to the brand of acquired or partnered companies that are well established in their respective sectors, Yeonsu said. “I think more brand value is created from having multiple brands, instead of having different brands follow one brand,” CEO said, which is markedly different from most South Korean conglomerates that like to unify different companies under one brand, such as Hyundai or SK.

She also makes it clear that the profitability of a company is very important. “The software sector in general gets a lot of venture capital funding. But to me, how venture capitals can invest in companies with wide losses is quite frankly a mystery. I think it comes from [them] always looking for the outlier in their perspective. In that sense, I guess the margin rate I want from Hancom and the companies it works with can be perceived as above the market average.”

At the same time, Yeonsu says how she looks at profitability, revenue, and valuation overall is nuanced. “Revenue may be high right now for a company. But I think we have to look at future profitability and growth. A company with a good resume isn’t always profitable. Whatever the situation is, a company’s value is determined I think by how it convinces its internal staff and external stakeholders of its visions and goals.”

The release of SDKs, the cultural shift, and acquisitions all have the end goal of propelling Hancom’s growth. “We are known for the Hangul Office in South Korea. I think there were many doubts about whether Hancom had room for growth.

“So what we are changing is selling our Office technologies, finding different values from the document solution we already posseses, and my job is to convince the internal staff that we can expand.

“In the past, since most of our customers came from the public sector, we had little incentive to find out the needs of customers. But now our priority is to find out deeply and accurately the needs of our customers. This will help us build a healthy ecosystem around our SDK.”

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)