Binance’s Co-founder & CEO Changpeng Zhao has given several interviews discussing the outlook for cryptocurrency following a turbulent couple of weeks in the market.

NurPhoto / Contributor / Getty Images

Over a month after the collapse of FTX, investor concern over crypto exchange Binance isn’t fading.

Binance’s native token, BNB, has fallen 15% in the past week, including a drop of over 6% in the past 24 hours. BNB, first minted in 2017, is the world’s fifth most valuable cryptocurrency, with a market cap of about $39 billion, according to CoinMarketCap. It’s behind only bitcoin, ethereum, tether and USD Coin.

The latest issue looming over Binance is FTX’s bankruptcy proceedings. Binance was the first outside investor in FTX. In exiting its equity position in the company last year, Binance received payment equal to roughly $2.1 billion.

In an interview with CNBC’s “Squawk Box” on Thursday, Binance CEO Changpeng Zhao dismissed concerns that his company could have that money clawed back as FTX winds its way through bankruptcy court and trustees look to retrieve any fraudulent conveyances made by FTX to outside businesses or investors.

“We are financially OK,” Zhao said, after he was asked by CNBC’s Becky Quick if the company could handle a $2.1 billion demand.

Crypto investors have become skeptical of comments from top executives about the financial health of their companies. FTX founder and ex-CEO Sam Bankman-Fried said on Twitter that his company’s assets were fine, even as executives knew it was in the midst of a liquidity crunch that eventually forced the exchange into bankruptcy. Bankman-Fried was arrested this week in the Bahamas and charged by U.S. prosecutors with fraud and money laundering.

Withdrawal demands are another area of concern. Zhao said that around $1.14 billion of net withdrawals took place on Tuesday, but tweeted that this was “not the highest withdrawals we processed, not even top [five].” On Wednesday, he said the situation had “stabilized.” Blockchain analytics firm Nansen said the withdrawal number on Tuesday reached as high as $3 billion.

A Binance spokesperson told CNBC in a statement that, “we passed this extreme stress test because we run a very simple business model – hold assets in custody and generate revenue from transaction fees.” The spokesperson did not provide an immediate response to a question about the drop in BNB.

Binance and FTX were intimately connected. Zhao announced publicly last month that his company was liquidating its position in FTT, FTX’s native coin, amid concerns surrounding the solvency of both FTX and its sister trading firm, Alameda Research.

FTX then faced an immediate surge in withdrawal demands, and Binance stepped in with a non-binding agreement to acquire the company as part of a rescue plan. A day later, Binance backed out of the deal, stating that FTX’s “issues are beyond our control or ability to help.”

Like all of the major crypto projects and companies, Binance developed its own currency. On its website, the company says people can “use BNB to pay for goods and services, settle transaction fees on Binance Smart Chain, participate in exclusive token sales and more.” Areas where BNB can be used, the site says, include payment, travel and entertainment.

There’s a circulating supply of about 160 million BNB out of a total maximum supply of 200 million, according to CoinMarketCap. Bloomberg reported in June that the SEC was investigating whether the 2017 token sale amounted to a security offered that should have been registered with regulators.

— CNBC’s MacKenzie Sigalos contributed to this report.

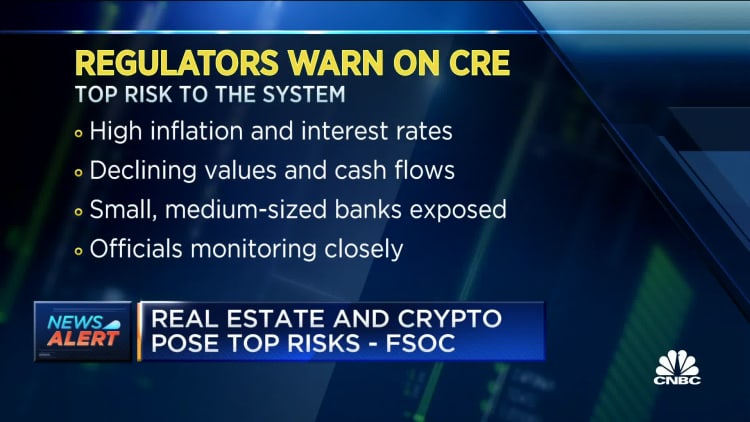

WATCH: Regulators highlight top risks: commercial real estate, credit losses, crypto

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)