DNY59

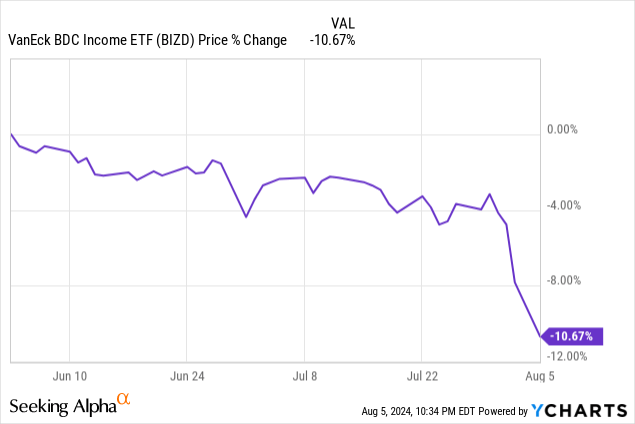

The business development company sector (BIZD) is now in a correction, as it has pulled back by over 10% in recent weeks.

This is not surprising, as the sector has faced a plethora of headwinds, and it appears increasingly likely that these headwinds will only increase moving forward. In this article, we will discuss what these headwinds are and what our approach to the BDC sector is moving forward.

Recession Increasingly Likely

The biggest headwind facing the BDC sector and what is sparking its most recent leg downward is the fact that the US jobs report last week signals that a recession is quite likely to hit in the near future. There are other reasons to be concerned about a recession coming as well, as consumer debt is at record levels, corporate debt is at record levels, consumer savings post-COVID have been completely depleted, and there are signs of consumer spending weakening as well as consumer sentiment weakening. On top of that, non-accruals have been rising gradually for several companies in the industry. Even Ares Capital’s (ARCC) CEO warned earlier this year that he expects non-accruals and defaults to spike in the industry this year:

I think the natural trend is likely to be…defaults pick up substantially…

We’ve said in the past that we’re likely to see defaults in the industry increase this year. It does take a little bit of time for that to manifest itself, right? So in the bottom quartile of our portfolio and probably everybody else’s, you have some companies that are making interest payments but continue to live off revolver availability, cash, et cetera, but the liquidity is getting tighter and tighter.

And so my expectation is that defaults will go up this year, probably more towards the historical norm. We’ve had a little bit of amendment activity that’s elevated; I think others probably have two but nothing that’s causing us a whole lot of concern. I think it’s just a regular letting out as obviously rates are higher and companies have higher debt service costs and all that. But generally, I think we’ll see that as well others.

Interest rates and inflation remain stubbornly high as well, which poses a further headwind for many BDC counterparties, as it increases their costs, which in turn makes it harder for them to meet their interest payments to BDC lenders.

Increasingly Unfavorable Risk-Reward

Another headwind facing the BDC sector is the increasingly unfavorable supply-demand balance for lenders as enormous amounts of money have poured into the space. Massive asset managers and lenders such as Blackstone Inc. (BX), JPMorgan Chase & Co. (JPM), The Goldman Sachs Group, Inc. (GS), Brookfield Asset Management Ltd. (BAM), Brookfield Corporation (BN), KKR & Co. Inc. (KKR), The Carlyle Group Inc. (CG), Apollo Global Management, Inc. (APO), Ares Management Corporation (ARES), Blue Owl Capital Inc. (OWL), and others are all investing aggressively in private credit and direct lending. This means that it is increasingly challenging for these lenders to find deals on attractive terms, especially at elevated yields. In particular, the second-lien loan market has seen its spreads to first-lien loans compress sharply, meaning that BDC lenders are increasingly being driven to first-lien loans instead of second-lien loans, which is reducing their net income.

Rate Cuts Increasingly Likely

A third headwind facing the sector is that rate cuts are now very likely, with the market pricing in a 100% chance of rate cuts at the Federal Reserve’s September meeting, including a 73.5% probability of a 50-basis point rate cut. The market expects additional significant rate cuts by year-end, with a whopping 88.5% probability of between a 100-basis point and 150-basis point reduction by the end of 2024, with more interest rate cuts set to follow in 2025. Given that most BDCs have the yields on the vast majority of their loans float relative to short-term interest rates, this will likely pose a significant headwind for their net investment income spreads. However, it should relieve some pressure on their counterparties at the same time and hopefully keep non-accruals from spiking too much.

Elevated Valuations

A final headwind that the BDC sector has been facing is that many leading BDCs have been driven up to trading at quite lofty valuations. When combined with the growing probability of Federal Reserve interest rate cuts, the outlook for the sector simply does not look attractive. For that reason, we had actually at one point nearly completely exited the space after making significant profits off of numerous BDC investments in blue chips like ARCC, Blackstone Secured Lending Fund (BXSL), and the likes of Golub Capital BDC (GBDC), with others such as Main Street Capital (MAIN) remaining at significant premiums to both NAV and their own historical averages.

Investor Takeaway

That being said, moving forward, there are still some reasons to be invested in BDCs. First and foremost, some of those blue-chip BDCs, such as Blue Owl Capital Corporation (OBDC), GBDC, and others, have pulled back now to trade at a discount to net asset value, making them much more attractive from a valuation perspective. Additionally, many of their balance sheets are in solid shape, with net leverage ratios of around one times, and their base dividends are fairly well covered by net investment income, making them pretty well insulated to some moderate Federal Reserve rate cuts. On top of that, they are generally overwhelmingly invested in senior secured loans and have talented underwriting teams with strong workout track records. So even if non-accruals do increase somewhat across the sector, these higher-quality BDCs should be able to weather the storm fairly well, even if their NAVs take a bit of a hit in the meantime.

As a result, while we think that now is not a time to be overweight in the BDC sector by any means, and we continue to steer clear of some of the more richly valued names, especially those with a bit less defensive investment portfolios, for stocks with very defensive investment portfolios and reasonably to even very attractive valuations, such as Oaktree Specialty Lending Corporation (OCSL), OBDC, and GBDC, we think that there are some opportunities that are worth buying and holding through the current uncertainty as part of a well-diversified high-yielding portfolio.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)