z1b

Last week, we shared 2 REITs to sell before 2023.

We explained that we recently sold Broadmark Realty (BRMK) because its leadership situation was too messy and its dividend wasn’t sustainable in light of the challenges that it was facing.

We also sold Iron Mountain (IRM) because it had become overpriced relative to other REITs and the risks of its paper storage business weren’t properly priced in.

But what are we buying with these proceeds?

It is difficult to decide because there are so many buying opportunities in the REIT sector right now. Most are down significantly in 2022 because the market worries about the impact of rising interest rates, but the reality is that:

- Rents are today growing the fastest in years.

- Balance sheets are the strongest ever.

- 2/3 of REITs have hiked full-year guidance.

- Cash flows are hitting new all-time highs.

- And dividend payments are being hiked.

So clearly, REITs are doing just fine from a fundamental perspective. Their market sentiment is today challenged because investors have decided to focus on a single factor (interest rates), and have forgotten about all the others (inflation, rents, balance sheets, etc.).

We think that this is a great opportunity for long-term-oriented investors who now get to buy real estate at pennies on the dollar through the discounted REIT market. Even the big players like Blackstone (BX) have taken notice of the opportunity and are now accumulating REITs.

In what follows, we highlight two REITs that we bought recently at High Yield Landlord:

Global Medical REIT (GMRE)

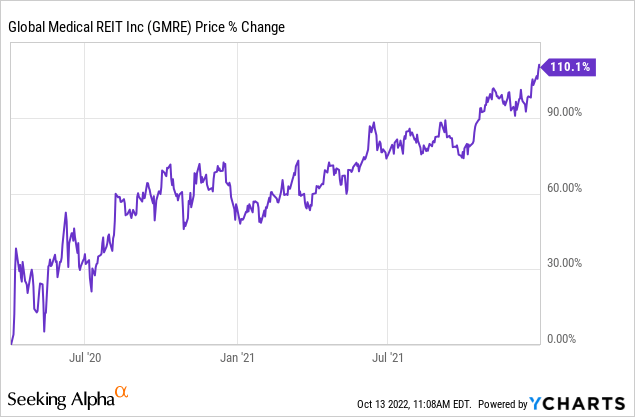

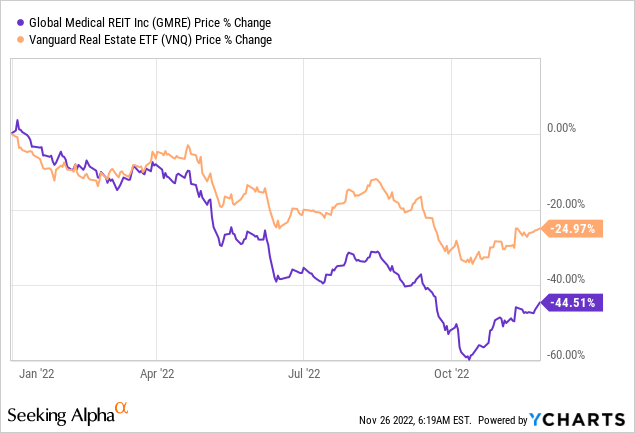

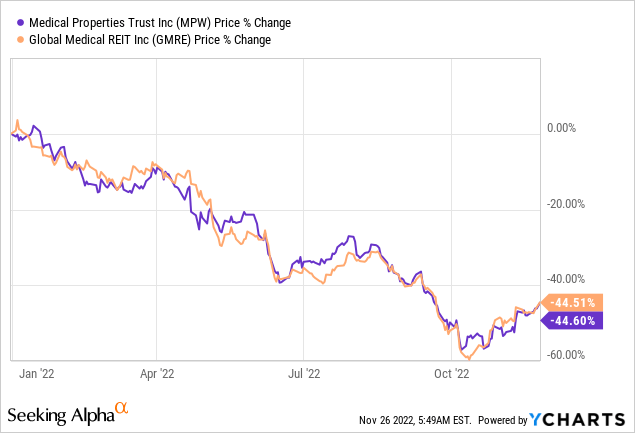

Global Medical REIT is a medical office REIT that has dropped by 40% year-to-date. That’s far more than the average drop of the REIT sector and also a lot more than even some of the most challenged REITs:

Here is a medical office owned by GMRE:

GMRE

But surprisingly, GMRE’s business has actually performed quite well even as its share price collapsed. We believe that the crash is unjustified and that it has now become deeply undervalued as a result of it.

Priced at a large discount to fair value, it now offers margin of safety, which should limit downside, and it also offers significant upside potential in a future recovery. Its share price could rise by over 50% and its valuation would still be reasonable. While you wait, you also earn an 8.5% dividend yield.

So why is GMRE down so heavily and why doesn’t it make sense?

We think that it is down 45% because of three main reasons:

Reason #1: concerns over its balance sheet

Firstly, GMRE has a bit more debt than your average REIT. This is nothing unusual for a smaller REIT that’s growth-oriented. But the market got particularly worried about GMRE because a large portion of its debt has a variable rate, which doesn’t bode well in today’s environment.

This led many analysts to downgrade GMRE. To give you a few examples, Baird and BMO both downgraded GMRE in the last week alone and both cited concerns over its variable debt structure. BMO specifically noted that they worry about the impact of rising rates since “39% of its debt is floating due to its revolver.”

But what they appear to have missed is that GMRE has hedges in place to mitigate the impact of rising interest rates. Dane Bowler correctly pointed this out in a recent article that you can read by clicking here. Here is the important section:

So that totals $500 million of hedges against $610 million of notional floating rate debt. As such, about $110 million is truly floating. That is still not ideal, but the impact to FFO is going to be significantly less.

$110 million at the now 210 basis point higher rate equates to about $2.31 million extra interest rate expense annually or about $0.033 per share.

Given that GMRE is growing at a pace exceeding 3 cents per share the extra interest rate expense will be quickly absorbed. It will still cause a slowing of growth, but is certainly not of a magnitude that justifies the nearly 50% drop in market price.

I expect the impact to be somewhat higher, but it certainly doesn’t justify a 45% drop in the share price. The market is very worried about leverage given that rates are rising so rapidly, but GMRE is much more resilient than the market appears to understand. It has a 45% LTV, most of it (~80%) is fixed thanks to the hedges, and it owns defensive medical office buildings that are enjoying steady rent escalations of 2.1% on average and larger releasing spreads upon lease expiration.

Reason #2: concerns over its tenants

Secondly, there have been a lot of concerns over the health of tenants in the healthcare property sector. I am sure you are aware of this because MPW short sellers have been very vocal about this risk and made everyone fearful.

Interestingly, GMRE is actually down just much as Medical Properties Trust (MPW), despite owning medical office buildings, which are more resilient than hospitals. GMRE enjoys a 5x rent coverage on average, which is nearly double that of MPW.

Some tenant-related issues are expected given that they are still dealing with pandemic-related issues, especially on the cost side of things, but with such high rent coverage (=high property-level profitability), GMRE should be fine overall.

Recently, one of its tenants, Pipeline Health, filed for bankruptcy and it caused GMRE to sell off heavily. But this tenant only represents 2% of GMRE’s revenue and based on what we know, GMRE’s property won’t be affected by this bankruptcy. If you read Pipeline’s bankruptcy filing, they make it clear that their financial problems stem from their hospitals in Illinois and GMRE does not own any of those:

This is particularly true with respect to the Company’s Illinois operations (collectively, the “Illinois Facilities”). The Illinois Facilities have required significant working capital and have posted large financial losses since they were acquired. In the twelve-month period ending in August 2022, the Illinois Facilities posted a net loss of approximately $69.7 million on a consolidated basis. (Pipeline’s bankruptcy filing)

GMRE owns a property in Texas and it has been profitable and subsidizing the losses in Illinois:

Due to the financial state of the Illinois Facilities, the Company’s California- and Texas- based healthcare operations have effectively subsidized the Illinois operations.

Therefore, I would expect Pipeline to reaffirm its leases for the property in Dallas. It surely does not want to lose its profitable assets. They will probably renegotiate the assets in Illinois and also seek to deleverage, but this is actually beneficial for GMRE.

So it seems to us that these recent headlines of tenant bankruptcy are more than noise than anything else. It is inevitable that you occasionally suffer tenant issues when you invest in higher cap rate properties like GMRE, but this does not mean that the property itself is bad or that the business model is poor.

Overall, GMRE has a 5x rent coverage and leases are nearly 7 years long. In the medical office space, revenue is very sticky for landlords because ~80% of leases are extended and we would expect the renewal rate to be even greater in the coming years since construction costs and interest rates are up significantly, which makes it much more expensive for tenants to build new properties or lease new ones.

Reason #3: concerns over the office sector

Finally, it appears that medical office REITs have been falsely categorized as “office REITs” and those are today experiencing much greater uncertainty. The same has happened for life science REIT Alexandria Real Estate (ARE), which is commonly included in office REIT peer groups, despite enjoying much stronger fundamentals.

Medical office buildings are not traditional offices. These are clinics that you visit to see your doctor and conduct tests and get treatments. You can work remotely from home, but you cannot get a colonoscopy remotely. Physicians are some of the best tenants because they enjoy good credit, high rent coverage, and the real estate is essential to their business, which is also recession-resistant.

We are glad to actually bump up our exposure to healthcare real estate as it is notoriously defensive during times of recessions and we appear to be headed into one right now.

The bottom line is that GMRE is now deeply undervalued and offers significant upside potential as the market corrects its mistake.

The last time GMRE was so cheap, it was following the pandemic crash in 2020 and it then proceeded to more than double in the following year. We think that GMRE could replicate that in the coming years:

Best of all, while we wait for the upside, we earn an 8.5% dividend yield. Typically, companies that pay such a high yield are risky, but we think that this dividend is sustainable.

A final piece of evidence that would suggest that GMRE is undervalued is that one of its healthcare peers Medical Properties Trust, recently announced a plan to buy back shares and this is happening after it suffers a similar crash. This transitions nicely to our next purchase:

Medical Properties Trust (MPW)

When MPW dropped to ~$10-11 per share, we bought more shares to average down our cost basis. MPW is similar to GMRE, but instead of investing in medical office buildings, it invests in hospitals, often abroad as well.

Below is a picture of a hospital that they own in Spain:

Medical Properties Trust

Just like GMRE, MPW is down a lot more than the rest of the REIT sector year-to-date and this is largely because the market worries about the health of MPW’s tenants:

Pipeline Health is also a tenant of MPW and so its bankruptcy also impacted its market sentiment as well. But again here, the impact shouldn’t be significant. MPW’s CEO has previously noted that its Pipeline properties are “very, very profitable” and Pipeline confirmed in its bankruptcy filing that the MPW properties have been “effectively subsidizing” the losses of other properties.

Therefore, we think that the most likely outcome is that the lease with Pipeline remains unchanged. They don’t want to lose these profitable assets and MPW could find another operator for them if needed. In any case, this is not such a big deal since Pipeline is a small tenant anyway.

A potentially more concerning tenant is Steward. It is its biggest tenant and short sellers claim that it is insolvent. This is really what sparked a lot of fears and caused MPW to sell off so heavily.

But in the last quarter, MPW noted that Steward is now experiencing some substantial improvements with labor costs going down, reimbursements going up, etc. and as a result, they are expected to be “strongly” free cash flow positive going forward at the corporate level.

Besides, it is important to remember that MPW is a landlord and therefore, it is primarily interested in the property-level profitability of its properties, and the Steward properties are profitable and enjoy a good rent coverage ratio.

Therefore, we think that the fears are overblown and the market is wrong to discount MPW so heavily based on risk factors that are yet to play out. We are not denying that MPW has risks, but these risks appear to be now decreasing, and yet, the market has priced it as if the risk factors had played out already.

Priced at less than 10x AFFO and offering a 9% dividend yield, we think that MPW is deeply undervalued.

Bottom Line

There are lots of opportunities in the REIT sector right now and we are doubling down on lots of our favorite names as we head into 2023.

Some of our favorite opportunities are in the healthcare property sector because they are recession resistant and heavily discounted. GMRE and MPW are just 2 out of ~25 REITs that we are currently accumulating.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)