anyaberkut

Rumble Inc. (NASDAQ:RUM) operates a user generated streaming media platform that is positioned as a more free speech-respecting alternative to similar platforms that are controlled by big tech companies. The sell to the consumer is simple and straightforward. Rumble the platform aims to offer content creators and content consumers an alternative to what many have viewed as poorly executed content moderation policies by user-generated content giant YouTube (GOOG). The company was launched in late 2013 by current CEO Chris Pavlovski with smaller creators in mind. Rumble came public via SPAC merger agreement with Cantor Fitzgerald Acquisition Corp. VI (CFVI) in December of last year. The deal officially closed this past September.

Revenue

Rumble the business mainly generates revenue from advertising and licensing fees. Platform Rumble allows users to upload content free of charge and monetize that material through advertising, content licensing, or a viewer tipping mechanism. For each of these services, business Rumble takes a fee for managing the hosting and distribution of the content. Additionally, business Rumble also operates Locals.com – a subscription-based video streaming service that Rumble’s content creators can use as a more stable recurring revenue stream rather than relying solely on advertising. Again, business Rumble takes a percentage of these transactions. The revenue growth in Q3 of 2022 was significant both year over year and sequentially

| Revenue | QoQ | YoY | |

|---|---|---|---|

| Q4-20 | $2,237,187 | N/A | N/A |

| Q1-21 | $2,332,463 | 4.3% | N/A |

| Q2-21 | $2,124,879 | -8.9% | N/A |

| Q3-21 | $2,069,473 | -2.6% | N/A |

| Q4-21 | $2,939,548 | 42.0% | 31.4% |

| Q1-22 | $4,044,765 | 37.6% | 73.4% |

| Q2-22 | $4,399,312 | 8.8% | 107.0% |

| Q3-22 | $10,983,182 | 149.7% | 430.7% |

Source: Q3-22 10-Q

The $11 million in Q3-22 revenue was an explosive 5x over the $2.1 million in revenue from Q3-21. Of the $8.9 million year over year revenue increase, 85% of it came from growth in advertising with the remaining $1.3 million coming from licensing and other revenues. Year to date, the company has seen just under 200% growth in year-over-year revenue.

| Nine Months ended Sep 30 | 2022 | 2021 | Change |

|---|---|---|---|

| Revenues | $19,427,259 | $6,526,815 | 198% |

| Cost of Revenues | $14,671,468 | $4,735,912 | 210% |

| Gross Profit | $4,755,791 | $1,790,903 | 166% |

Source: Q3-22 10-Q

Cost of revenue has outpaced revenue growth so far in 2022 which slightly dinged gross profit for the nine months ended September 30th from 27% in 2021 down to 24% now. On the conference call, Chris Pavlovski attributed this to spending on expansion initiatives and key creators.

Growth Trend and Strategy

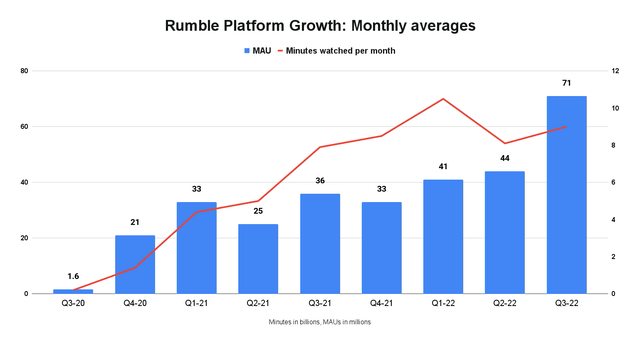

The large spike in revenue is partially attributable to the increased adoption of the Rumble platform. But at least some of the revenue growth is likely due to Rumble’s sponsored ad model. Rumble’s latest 10-Q breaks out key platform metrics as monthly averages by quarter. With 71 million monthly average users in the last quarter, Rumble’s MAU growth was 61% quarter over quarter even as minutes watched per month was actually below Q1-22 levels.

Author generated visual (Rumble/10Q)

On the conference call earlier this month, CEO Chris Pavlovski seemed to indicate this surge in ad revenue has been boosted in a big way by Rumble’s sponsored ad strategy and the company plans to keep moving forward with that approach:

We’re all kind of familiar with programmatic advertising. But we’re not so familiar with the sponsored advertising. And from what we’re seeing in Q3, that is an enormous market for us, and it’s something that we want to focus very heavily in.

The growth in both video platform usage and revenue is impressive. But Rumble is in a competitive streaming market and is building out complimentary models. One such idea is a cloud storage business that theoretically has a strong synergy for a couple of key reasons. First, video streaming requires substantial bandwidth and processing capacity. Since Rumble utilizes this kind of computer power infrastructure, it makes sense to enter the cloud storage space as well. The second reason this is an interesting synergy is because of the potential differences in content moderation policies between Rumble and other cloud storage or hosting providers.

Rumble can position itself as a cloud provider for like-minded businesses that fear de-platforming from less friendly cloud services. Another social platform positioned as a free speech alternative to big tech was Parler. That company was somewhat infamously de-platformed by Amazon Web Services (AMZN), Apple’s (AAPL) app store, and the Google Play store within a very short amount of time. Companies like TRUTH Social have seemingly learned from the Parler incident and are using Rumble for these kinds of services.

Valuation & Balance Sheet

Based on just about any traditional valuation metric, Rumble is wildly overvalued compared to other companies in the ad-based streaming space; even when compared to those that have enjoyed growth stock valuations in recent years.

| TTM | RUM | ROKU | CSSE |

| Price/Sales | 54.19 | 2.35 | 0.58 |

| EV/Sales | 103.05 | 2.08 | 3.36 |

| Price to Book | 7.52 | 2.7 | 1.06 |

Source: Seeking Alpha

It’s difficult to project the value of the business going forward because of both the lack of guidance from company leadership and also the lack of history of the stock. We don’t know how successful the cloud business will be or what level of revenue that could realistically bring in for 2023 and beyond. But glancing at the balance sheet, we can see a very robust sheet compared to peers.

| RUM | ROKU | CSSE | |

| Total Cash | 356.68M | 2.02B | 32.20M |

| Total Debt | 1.56M | 702.00M | 482.94M |

| Net Debt | -355.12M | -1.32B | 450.74M |

| Total Debt to Equity | 0.46% | 25.27% | 385.43% |

Source: Seeking Alpha

Rumble is slightly different from Chicken Soup for the Soul (CSSE) and Roku (ROKU) in that the content is user-generated. That said, all three entities are reliant on advertising from streaming video for a significant portion of company revenue. Rumble has plenty of cash, no debt, a lot of momentum, and a pitch that works in a social media market that seems to be pushing back on cancel culture judging from Elon Musk’s acquisition of Twitter and the growth of censorship-resistant platforms like Substack.

Risks

I see the biggest risk to the company in the ad-based model itself. A large percentage of Rumble’s revenue growth is coming from advertising and that can be problematic in what could be the beginning of an economic slowdown. Beyond that, the company said in its 10-Q from Q3 that a substantial amount of the company’s revenue comes from just a few customers:

For the three and nine months ended September 30, 2022, a few customers accounted for $7,916,653 and $12,163,616 or 72% and 63% of revenue, respectively. For the three and nine months ended September 30, 2021, a few customers accounted for $1,657,651 and $5,595,704 or 80% and 86% of revenue, respectively.

While “few” is not defined, it does appear that the reliance on top accounts has improved over last year, coming down from 86% of revenue through Q3 in 2021 to 63% now.

Summary

I like the idea of Rumble a lot. I think the platform is solid and has a surprisingly diverse array of content creators. It has a Roku app and can easily be viewed by CTV audiences. All that said, I do not currently have any exposure to RUM stock because I think it’s too risky buying a company this overvalued in a broad market that still faces headwinds from more central bank rate hikes and the potential for a global recession.

While Rumble certainly doesn’t need to raise cash anytime soon, I still think it’s early to jump into this one. Bulls could certainly make the argument that Rumble will grow into this valuation but I want to see another quarter of company performance before going long. If this kind of platform growth and revenue growth continues, it’ll be hard to not go long RUM especially if the price comes down a bit.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)