AsiaVision/E+ via Getty Images

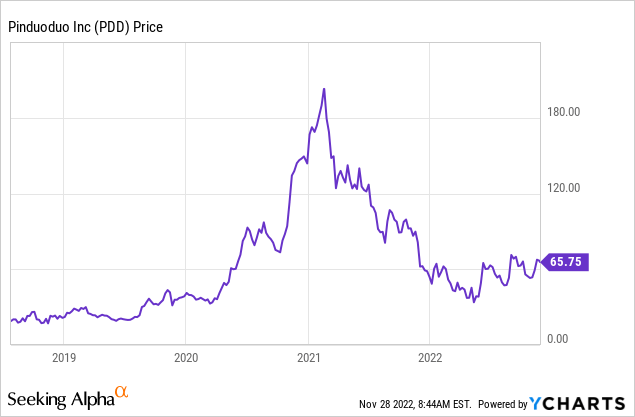

Pinduoduo (NASDAQ:PDD) is an innovative technology company that has pioneered the concept of social team-based shopping (which I will explain more about later). The company has recently reported strong financials for the third quarter of 2022, as it beat both revenue and earnings growth estimates. The company is also poised to continually benefit from the growing middle class in China. Thus, in this post, I’m going to break down its financials and valuation. Let’s dive in.

Innovative Business Model

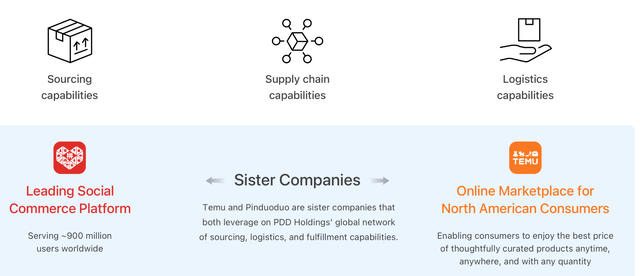

PDD Holdings consists of two main businesses: Pinduoduo, a social e-commerce platform; and Temu, an E-commerce marketplace for North American customers.

Pinduoduo pioneered the “Team Purchase” method which enables customers to form “teams” and purchase goods directly from suppliers at huge discounts. Its marketing tagline sums this up perfectly “Together, More savings, More fun”. As a western consumer, I am surprised to see that a company such as Meta (META) or Amazon (AMZN) hasn’t tried to copy this innovative feature. The beauty of a “social commerce” model is it also results in low-cost user acquisition as existing customers will tell their friends to sign up as both sides have an incentive.

Pinduoduo business model (Official website)

The company has over 900 million customers and 16 million businesses in its ecosystem. The company has also built out a vast logistics and fulfillment network which could act as a barrier to entry versus competitors.

Third Quarter Financials

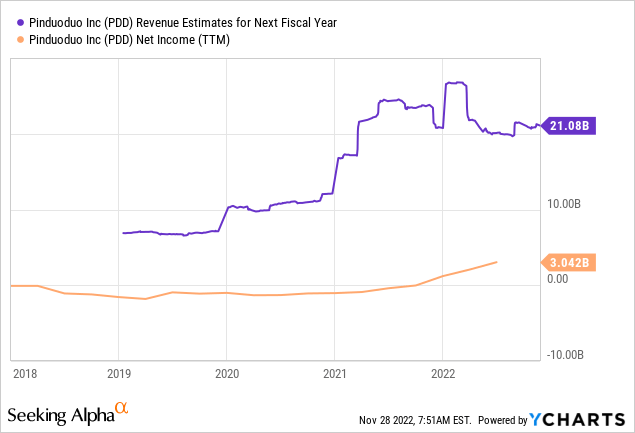

Pinduoduo reported solid financial results for the third quarter of 2022. Revenue was $4.99 billion (RMB 35.5 Billion) which increased by a blistering 65% year over year. This revenue was driven primarily by growth in the company’s online marketing services revenue which makes up ~80% of total revenue and increased by an outstanding 58% year over year to $3.996 billion. Transaction services revenue also increased strongly to $987 billion up a blistering 102% year over year. However, Merchandise sales declined by an eye-watering 31% year over year to $7.9 million.

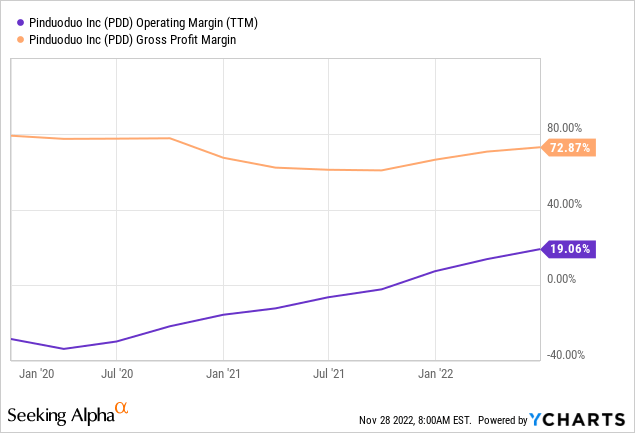

The company did experience a 13% increase in its cost of revenue to $1 billion, due to higher fulfillment costs and payment processing fees.

Operating Expenses were $2.48 billion (RMB 17.7 billion) which increased by an eye-watering 38% year over year. A silver lining is the growth in expenses was mainly driven by Sales and Marketing expenses. S&M expenses were $1.98 billion which increased by 40% year over year, which was mainly driven by increased advertising activities. Overall, I don’t deem this to be a major issue assuming the company is acquiring customers and generating sales in a manner that is profitable on a long-term basis.

General and Administrative expenses expanded to $127.4 million which increased by a terrible 171% year over year. Again, a silver lining is this was primarily due to higher employee costs, which is not necessarily a bad thing in the long term as it is better to pay employees well than to continually pay out expenses to recruiting companies.

Research and Development expenses were $379.3 million which increased by a rapid 11% year over year. This was driven by increased headcount as the company hired more experienced R&D workers. Companies that invest lots of profits into R&D tend to produce greater shareholder returns over the long term, therefore I don’t deem this expense to be terrible either.

The company reported an Operating Profit of $1.5 billion which increased by an exceptional 388% year over year. On a Non-GAAP basis Operating income increased by a modest 277% year over year to $1.7 billion.

PDD also reported solid net cash flow of $1.6 billion (RMB 11.652 million), which increased by 33.4% year over year. Pinduoduo has a solid balance sheet with Cash, Cash equivalents, and short-term investments of $19.4 billion. The company has ~$1.6 billion in convertible bond-based long-term debt, which is manageable.

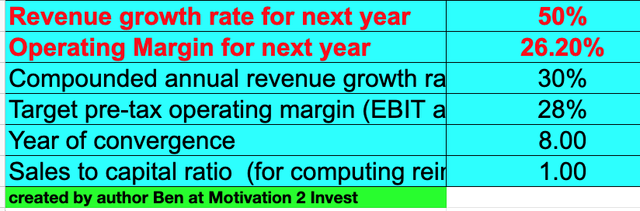

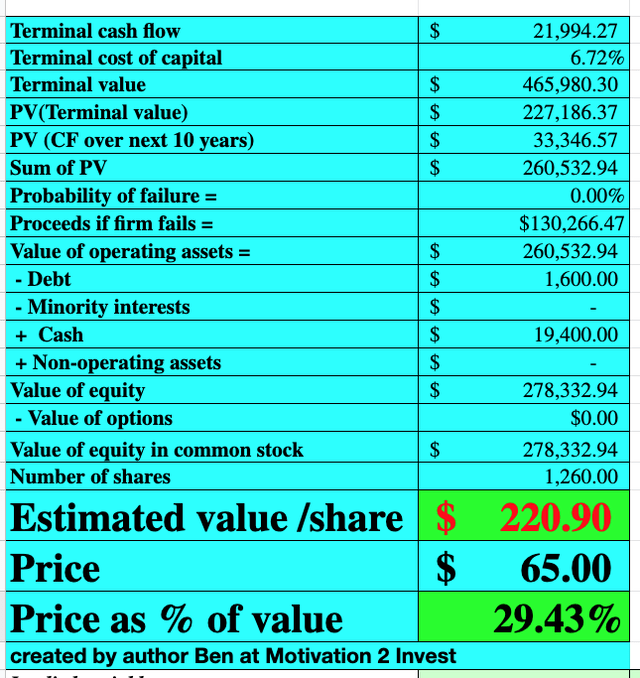

Advanced Valuation

In order to value Pinduoduo, I have plugged the latest financial data into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a 50% revenue growth for next year and 30% over the next 2 to 5 years. This is slower than prior growth rates of 65% and is fairly conservative in my view.

Pinduoduo stock valuation (created by author Ben at Motivation 2 Invest)

In order to increase the accuracy of the valuation I have capitalized R&D expense which has lifted net income. In addition, I have forecasted its operating margin to increase to 28% over the next 8 years, as inflation pressures ease in supply chains.

Pinduoduo stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $221 per share, the stock is trading at $65 per share at the time of writing and is thus 70% undervalued. This offers a significant margin of safety when investing.

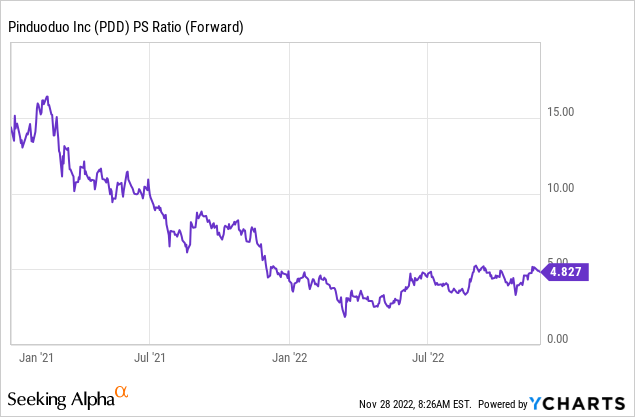

As an extra data point, Pinduoduo trades at a Price to Sales ratio = 5 which is 54% cheaper than its 5-year average.

Risks

Chinese Government Risks

Recently there have been a series of protests in China calling for the “undisputable leader” President Xi Jinping to step down. These protests are only isolated incidents so far, but highlight the bigger issue of the Chinese government’s role in the people of China’s life and businesses. Tech giant Alibaba (BABA) was previously slapped with a $1.2 billion fine, after Jack Ma criticized the Chinese Financial system. Then over in the U.S.A. we have the SEC which has created a hitlist of Chinese stocks to kick off U.S. exchanges if they don’t comply with accounting standards.

Final Thoughts

Pinduoduo is a tremendous company and true pioneer in the world of social commerce. The company has recently posted tremendous financial results and the stock is undervalued. I think the only major risk is the “China Risk” and thus that must be taken into account when investing, and allocated in your portfolio in a diversified manner.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)